Extra Credit: Payment Models, Risk and Reward

This section provides some important conceptual information that underlies payment reform theory.

There are four types of Financial Risk/Reward in the Arizona RBHA system:

The following diagram provides a high level view of this Risk/Reward equation.

[DIAGRAM HERE]

Each of the types of Risk/Reward is defined below, followed by an example. For all the examples, we are making the following assumptions:

The RBHA and its Providers worked together to answer the following questions:

This example does NOT include any Pay For Performance/Bonus/Shared Savings components; that comes later

Let’s now look at each type of Risk/Reward.

There are four types of Financial Risk/Reward in the Arizona RBHA system:

- Cost: Services cost more (or less) per unit than the payment rate.

- Individual Utilization: Individuals, on average, use more (or less) units of service than estimated.

- Case Mix: The mix of patients is weighted toward higher severity or complexity than estimated.

- Penetration: More (or less) individuals from the covered population use services than estimated.

The following diagram provides a high level view of this Risk/Reward equation.

[DIAGRAM HERE]

Each of the types of Risk/Reward is defined below, followed by an example. For all the examples, we are making the following assumptions:

The RBHA and its Providers worked together to answer the following questions:

- How many people will need behavioral health services next year?

- What types of services will they need?

- How much service will they need?

- What does it cost to efficiently provide a unit if service?

- Does the RBHA have enough money to cover the demand?

- If not, what adjustments are needed?

This example does NOT include any Pay For Performance/Bonus/Shared Savings components; that comes later

Let’s now look at each type of Risk/Reward.

|

1. Cost Risk/Reward

Definition: If a given unit of service costs more than the anticipated unit cost, the Payor or Provider is at risk for covering the additional cost, depending on the Payment Model. If that same unit of service costs less, the same party who is at risk will also reap the reward. |

RVUs and CFs: Healthcare fees are often set based on weighting each service with some type of Relative Value Unit (RVU) and then for each service, multiplying the RVU by a Conversion Factor (CF). |

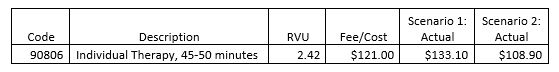

Example: Provider ABC provides one unit of 90806 to RBHA ZYZ. The Fee for this service is $121.00, which is based on 2.42 Relative Value Units (RVUs) times a Conversion Factor (CF) of $50.00.

In Scenario 1, the actual cost turns out to be higher ($133.10); in Scenario 2, the actual cost is lower ($108.90), as illustrated below.

In Scenario 1, the actual cost turns out to be higher ($133.10); in Scenario 2, the actual cost is lower ($108.90), as illustrated below.

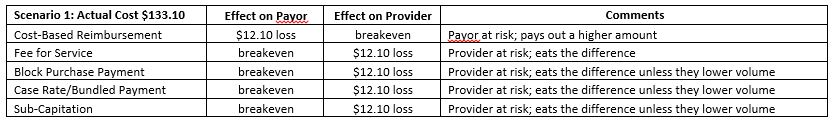

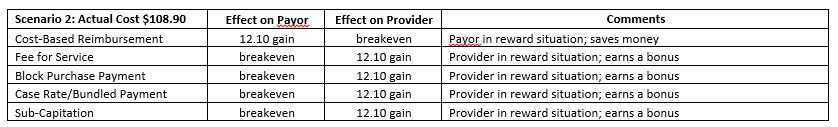

The following tables connects these assumptions to five Payment Models that might be used by a Behavioral Health Payor.

This example is straightforward. For all Payment Models except Cost-Based Reimbursement, the Cost Risk/Reward is held by the Providers. If a Provider is able to provide a service for less than the agreed upon Fee/Cost, the provider earns a Cost Reward. If the Provider’s Cost is more than the agreed upon Fee/Cost, the Provider has to make some type of adjustment or they will lose money.

The math problem embedded in this example carries forward to the next three categories of Financial Risk/Reward.

The math problem embedded in this example carries forward to the next three categories of Financial Risk/Reward.

2. Utilization Risk/Reward

[UNDER CONSTRUCTION]

3. Case Mix Risk/Reward

[UNDER CONSTRUCTION]

4. Penetration Risk/Reward

[UNDER CONSTRUCTION]

[UNDER CONSTRUCTION]

3. Case Mix Risk/Reward

[UNDER CONSTRUCTION]

4. Penetration Risk/Reward

[UNDER CONSTRUCTION]