The Risk/Reward Equation

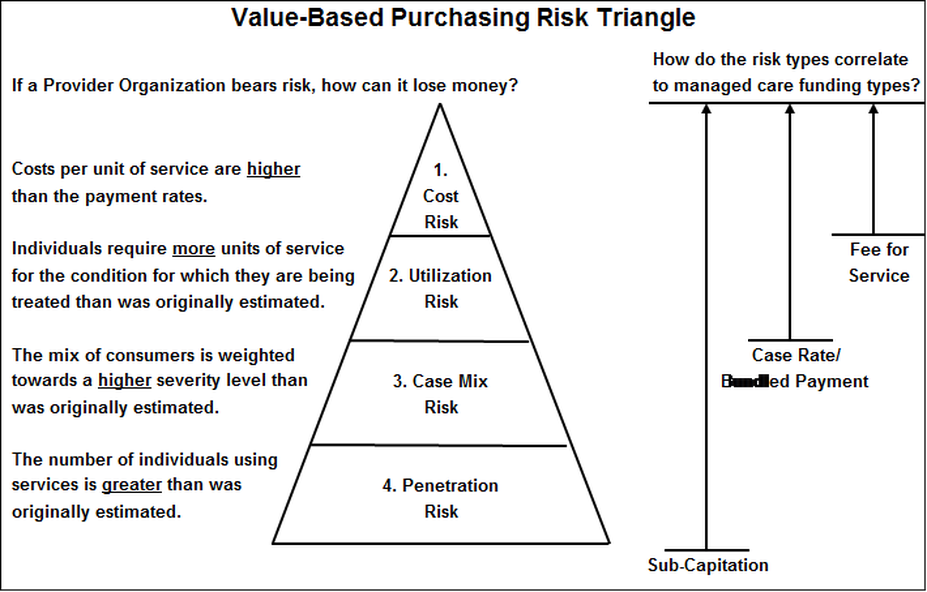

Let’s begin to examine how the Payment Model is the method by which Dollars and four types of Risk and Reward are transferred from the Payor to the Provider. This is best illustrated by the following two Value-Based Purchasing Risk Triangle diagrams.

The Risk Side of the Equation

When a Provider is paid Fee for Service, they take on Cost Risk. Utilization Risk Case Mix Risk, and Penetration Risk stay with the Payor.

When a Provider is paid with a Case Rate/Bundled Payment, they take on two types of risk: Cost Risk and Utilization Risk. Case Mix Risk, and Penetration Risk stay with the Payor.

When a Provider is paid on a Sub-Capitation Basis, they take on Cost Risk, Utilization Risk, and Case Mix Risk. Only Penetration Risk stays with the Payor.

The Risk Side of the Equation

When a Provider is paid Fee for Service, they take on Cost Risk. Utilization Risk Case Mix Risk, and Penetration Risk stay with the Payor.

When a Provider is paid with a Case Rate/Bundled Payment, they take on two types of risk: Cost Risk and Utilization Risk. Case Mix Risk, and Penetration Risk stay with the Payor.

When a Provider is paid on a Sub-Capitation Basis, they take on Cost Risk, Utilization Risk, and Case Mix Risk. Only Penetration Risk stays with the Payor.

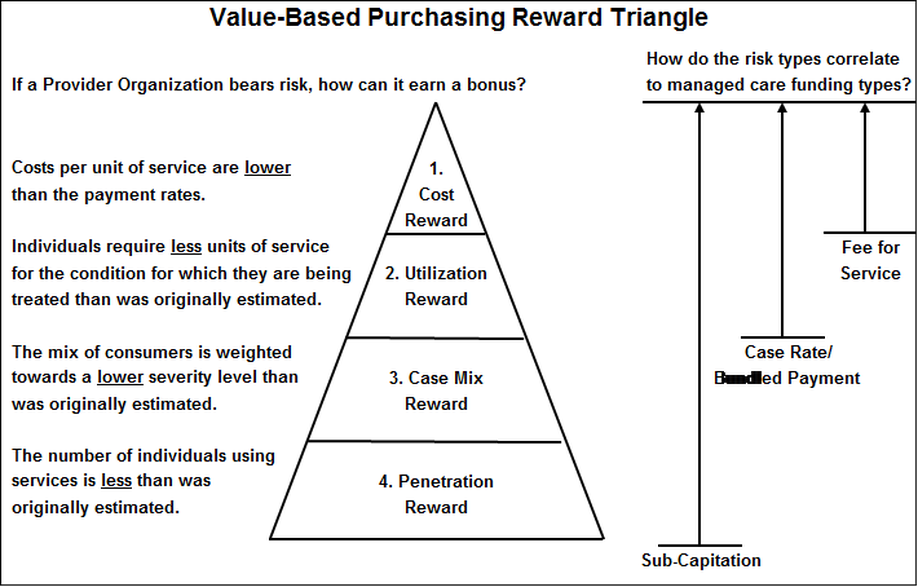

The Reward Side of the Equation

The other side of Risk is Reward, which is illustrated by a second version of the Risk Triangle where connection between potential rewards to the Provider Organization and the Payment Models are described.

The other side of Risk is Reward, which is illustrated by a second version of the Risk Triangle where connection between potential rewards to the Provider Organization and the Payment Models are described.